Selecting a virtual card for advertising payments on platforms like Facebook, Google, TikTok, and Microsoft is no easy task. Each advertising service has its own payment requirements, and not every card can meet them fully. In this article, we will explore the top five virtual cards that can help you effectively manage your advertising budgets across various platforms.

The challenges in choosing the right card often arise due to differences in terms of use, fees, limits, and supported currencies. A card that works perfectly for one advertising platform may be inconvenient or unprofitable for another. Therefore, it’s crucial to thoroughly analyze the available options and choose those that best meet your needs.

Consider using a virtual credit card instead of a debit card for more convenience. For instance, if you need to temporarily increase your advertising budget, a credit card can offer the flexibility in expense management and the possibility of deferring payments.

Here are five practical tips to help you make the best choice:

-

Check Transaction Fees

Understand the fees charged by the service for topping up and making payments. Sometimes seemingly attractive terms can hide high maintenance costs.

-

Evaluate Limits and Restrictions

Pay attention to transaction and top-up limits. Cards with low limits can restrict your advertising activities.

-

Choose a Card with Appropriate Currencies

Ensure that the card supports the currency of your ad campaign. This will help you avoid additional currency conversion costs.

-

Explore Bonus Programs and Cashback

Some cards offer bonuses or cashback for usage. This can be a nice addition to your advertising expenses.

-

Check Usability and Support Quality

The interface and support service play a significant role in your daily operations. Make sure the service provides a user-friendly interface and prompt support.

Next, we’ll review the key features and advantages of the top five virtual cards for ad payments.

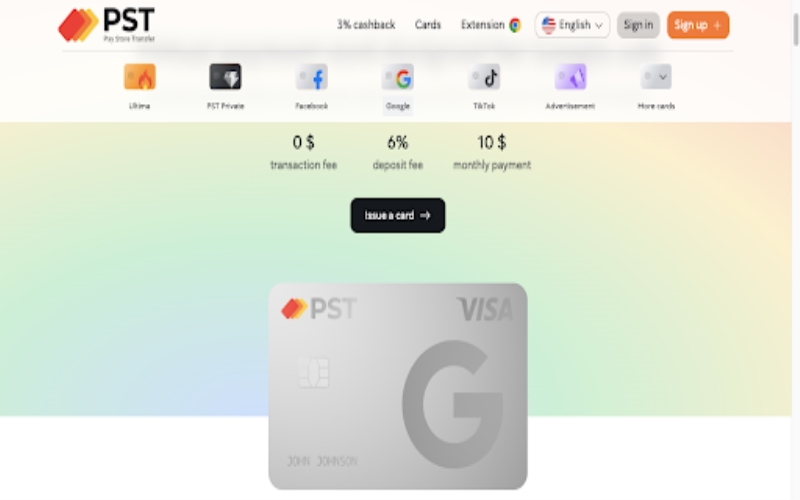

1. PSTNET

PSTNET is a financial service that issues various types of virtual cards. The service offers a card for unlimited purchases called Ultima, as well as specialized cards for media buying. They have cards for Facebook, Google, TikTok, Microsoft, and many other advertising platforms.

All cards from this service work with Visa/Mastercard payment systems and come in either debit or credit forms. According to users, the service offers the best credit card for ad spend. They have low top-up fees and offer 3% cashback on ad spending.

None of the cards from this service charge transaction fees, withdrawal fees, or fees for operations on frozen or blocked cards.

Let’s consider the features of the service using the virtual card for Google ads as an example. Note that the advantages of the service are available to every user, regardless of which card they choose.

Key Features:

- Top-up Fee: 3%

- 25+ Unique BINs with European and US Geos: Minimizing the risk of payment issues

- Online BIN Checker “Pulse”: Quick access to detailed card information

- Crypto Top-ups: Supports 17 cryptocurrencies (BTC, USDT TRC 20, ERC 20, and others)

- Standard Top-up Methods: Bank transfers (SWIFT/SEPA), other Visa/Mastercard cards

- 3D Secure Technology: Provides an additional layer of payment security

- Team Collaboration Tools: Allows task distribution, role assignment within teams, and setting card limits

- Expense Analytics: Financial operation reports are available to users

- Telegram Bot: Enables 3D Secure Codes retrieval and service update notifications

- 1-Minute Registration on the Platform: Can use Apple ID, Google, Telegram, WhatsApp accounts, or email

- 24/7 Customer Support: Support specialists respond instantly via Telegram, WhatsApp, or live chat

- PST Private Program: Users can issue up to 100 free cards per month and enjoy other bonuses

2. MyBrocard

MyBrocard is a financial service that exclusively offers virtual cards for advertising payments. The service’s virtual cards support major payment systems such as Visa and Mastercard. All cards are debit, and you can issue an unlimited number of them. The first 50 cards for ad payments can be issued for free, with subsequent cards priced based on their BIN.

Key Features:

- Top-up Fees: Ranging from 3% to 7%

- Unique BINs: Over 20 BINs available, including those from the U.S., Estonia, the UK, and Colombia

- Crypto Top-ups: Supports USDT (TRC20 and ERC20)

- Standard Top-up Methods: Bank transfers (available only for legal entities), Capitalist, Marketcall

- Fees for Operations on Blocked or Frozen Cards: Depends on the transaction amount

- Team Collaboration Tools: Allows task distribution, role assignment within teams, and setting card limits

- Expense Analytics: Provides tools for analyzing expenses via the dashboard

- Registration Process: Takes no more than 24 hours, including filling out a standard form on the website and completing the KYC process (uploading a selfie with a passport and waiting for verification, which takes about 24 hours). Cards are issued instantly after topping up the account with a minimum of $500

- 24/7 Customer Support: Support is available through live chat

3. Spendge

Spendge is a financial service designed specifically for managing advertising budgets on popular platforms such as Facebook, Google, and Microsoft. It ensures convenience and efficiency in working with virtual cards. You can issue an unlimited number of any cards from the service.

Key Features:

- Fees: Low fees for financial operations, no fees for internal payments, international transactions – 1% + $0.30

- Unique BINs: A wide range of diverse BINs, which are constantly updated

- Crypto Top-ups: Supports over 30 cryptocurrencies, including USDT TRC20

- Standard Top-up Methods: Bank transfers (SWIFT/SEPA), Visa/Mastercard cards, Capitalist, transfers from partner service balances

- Expense Analytics: Detailed operation reports available

- Security of Transactions: Some BINs offer 3D Secure protection for card issuance

- Team Collaboration Tools: Allows task distribution, role assignment, and setting card limits

- Expense Analytics: Tools available for generating detailed financial operation reports

- Registration: Fast registration within 24 hours with real-time status tracking

- 24/7 Customer Support: Support is available around the clock, ready to promptly respond to user inquiries

4. EPN

EPN.net issues cards specifically for arbitrage on platforms like Google, TikTok, Pinterest, and many others. The service’s cards are issued by U.S. banks and work with Visa and Mastercard payment systems. All cards come with 3D Secure technology to protect financial transactions.

Key Features:

- Zero Fees: No fees for transactions or declined operations if conditions are met

- Crypto Top-ups: Supports USDT (TRC20), BTC

- Standard Top-up Methods: PayPal and AdvCash, other Visa/Mastercard cards, and bank transfers

- Telegram Bot: For managing card balances, 3DS codes, and notifications

- Team Collaboration Tools: Available in the personal account

- Expense Analytics: Detailed statements can be obtained for each account, with the option to set up automatic statement generation

- Registration: Sign up via Google account or email

- 24/7 Customer Support: Available through Telegram or the ticket system on the website

5. YeezyPay

YeezyPay is a financial service that issues virtual cards with Visa, Mastercard, and UnionPay support for advertising account payments. The service’s cards are well-suited for all popular platforms and are issued by banks in Europe and the U.S.

It’s important to note that the service’s cards have limits and restrictions on spending.

Key Features:

- Zero Fees: No fees for transactions and withdrawals

- Trusted BINs: Users have access to 5 types of BINs from reliable banks

- Team Collaboration Tools: Not provided

- Expense Analysis: Not available, but expense reports can be requested via Telegram bot

- Crypto Top-ups: Supports USDT (TRC20)

- Standard Top-up Methods: Not supported

- Registration: Through a Telegram bot, a link to the personal account is sent

- 24/7 Technical Support: Available via Telegram

Choosing a virtual card for advertising payments on platforms like Facebook, Google, TikTok, and Microsoft requires careful consideration of factors such as fees, limits, supported currencies, and top-up options. Virtual cards offer a convenient tool for managing advertising budgets, but their selection should be based on the specific requirements of each advertising platform.

The analysis reviewed five leading financial services, each offering unique advantages. PSTNET stands out with low fees and a wide selection of BINs, minimizing the risk of payment rejection. MyBrocard attracts the ability to issue a large number of cards and the diversity of supported payment systems. Spendge offers low fees and a high level of security with 3D Secure. EPN targets arbitrageurs, providing zero fees and cryptocurrency support. YeezyPay offers cards with minimal fees but limited team collaboration and analytics features.

Thus, for a successful card choice, it is crucial to consider the specifics of your advertising activities and the requirements of the particular platform. By following the above tips and recommendations, you can select the optimal service that will not only simplify budget management but also increase the efficiency of your advertising campaigns.