According to JPMorgan Chase analysts’ most recent analysis on the damaging effects of inflation on the economy, two out of every three small and midsize US firms anticipate the nation entering a recession in the upcoming year.

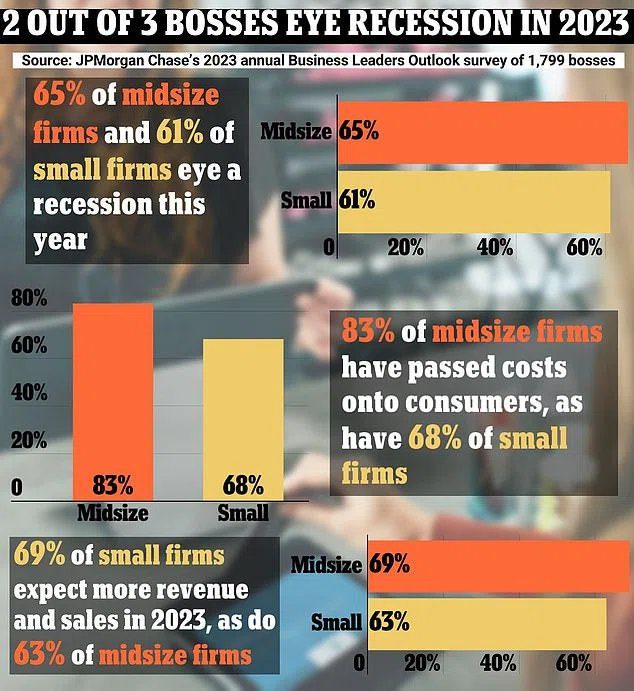

According to the Wall Street bank’s 2023 annual Business Leaders Outlook, which was published on Thursday, 61 percent of small businesses and 65 percent of medium businesses are anticipating a recession, while most small business owners anticipate that high prices would persist.

The results are consistent with recent economist and consumer surveys that predict the US will at the very least face a “slowcession” of growth that is close to zero, as well as continued high inflation and economic hardships from 2022.

They also come after this week’s major layoff announcements from Salesforce and Amazon, which affected a combined 26,000 workers this year. These announcements mark the latest job losses in a difficult time for the tech industry.

The ‘difficult headwind’ of inflation, which reached a 40-year high of 9.1 percent in June, has’started to decline and should cool over 2023,’ according to Ginger Chambless, a lead researcher with JPMorgan Chase.

She nevertheless issued a warning, stating that businesses “may still wish to consider adjustments to strategies, pricing, or product mixtures to help weather the storm in the near term” because rising costs will have an impact on spending for months to come.

While 45 percent of small business owners said rising prices were their top concern, a 20 percent increase from last year’s study, 90 percent of midsize company executives claimed their organizations were struggling to keep up with inflation.

2023 has gotten off to a bad start, but executives still seem optimistic. In a poll of 1,799 CEOs, it was discovered that almost two thirds anticipated rising revenue and sales this year, and roughly half anticipated rising profits.

Following this week’s 1,800-adult Gallup survey, which indicated that Americans entered 2023 expecting increased economic unpredictability, political unrest, and higher rates of unemployment and crime, comes JPMorgan Chase’s study.

Eight out of ten people predict that 2023 will be a challenging year economically, with more taxes and a widening budget deficit. More than six out of ten people predict that prices will increase rapidly and the stock market will decline in the upcoming year.

These feelings are in line with the depressing economic trends of 2022, which will be Wall Street’s worst year since the 2008 Global Financial Crisis, when inflation soared to a 40-year high of 9.1 percent in June.

The Federal Reserve may decide to keep raising interest rates even though the annual inflation rate fell to 7.1 percent in November. Interest rates were close to zero in March but will reach 4.25 to 4.5 percent by the end of 2022.

Similarly, a Wall Street Journal poll this week of 23 key dealers—the huge financial institutions that transact business directly with the Fed—found that the majority of respondents anticipate a recession in the upcoming year.

In its own assessment, Moody’s Analytics predicted that the US may avoid a full-blown recession but would nonetheless go through a “slowcession,” in which economic growth slows to almost zero.

According to Mark Zandi, chief economist at Moody’s, “the economy is destined to have a rough 2023 under almost every scenario.”

But the fundamentals of the economy are strong, and inflation is quickly declining. The economy should avoid a full-blown downturn with a little luck and some relatively clever policymaking by the Fed.

By the Fed’s favored metric, inflation is still approaching its 2 percent target by almost three times.

Consumers have been compelled by rising prices to quickly use down savings, which thanks to stimulus measures and a brake in spending grew during the COVID-19 pandemic.

In comparison to the pre-pandemic average of 8.8 percent in 2019, the personal savings rate fell to 2.4 percent in November.

Additionally, consumers have been using credit cards more frequently to cover expenses.

According to data from the Fed, total household borrowing rose to $16.51 trillion in the third quarter, up $351 billion from the second quarter and 8.3 percent from a year earlier, the fastest annual growth in 14 years.

The housing market, which showed a decline in sales activity in the second half of last year, has been most significantly impacted by higher interest rates.

For the first time since 2002, the 30-year fixed mortgage rate exceeded 7 percent in October, more than tripling in just nine months.

Due to historically cheap borrowing costs and a migration to the suburbs during the pandemic, it deflated a hot housing market.

According to the National Association of Realtors, existing house sales plummeted 35.4 percent in November compared to November of the previous year, or 7.7 percent from October.

The NAR also noted that the current ten-month decreases streak is the longest ever recorded in statistics going back to 1999.

A typical leading indication of a recession, banks have also tightened their lending requirements in recent months.

Numerous analysts have been perplexed by the economy’s contradictory signals since the outbreak.

At 3.7 percent, the unemployment rate is still very low. It is anticipated by Fed policymakers to increase to 4.4 percent this year.

Much of 2022 was spent by the stock market preparing for a decline. The benchmark S&P 500 index lost 19.4% of its value by year’s end.

After the S&P 500 registered a gain of nearly 27 percent in 2021, it is only the market’s third annual decline since the financial crisis 14 years ago. This represents a painful reversal for investors.

S&P Dow Jones Indices estimates that the index’s value overall decreased by $8.2 trillion.